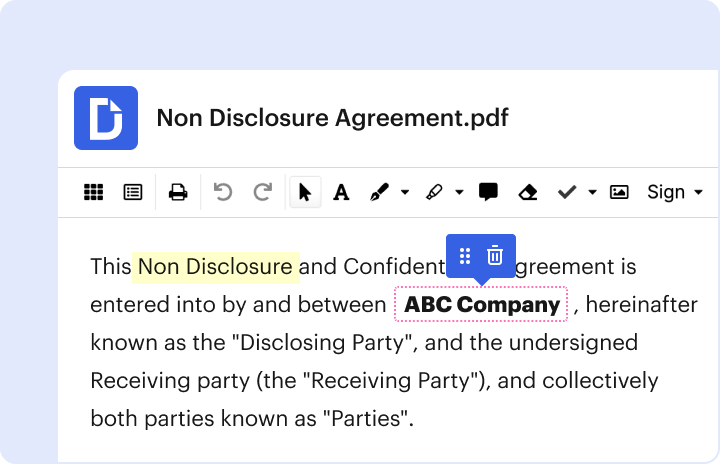

Dochub is a perfect editor for modifying your paperwork online. Adhere to this straightforward guide to edit Application for standby letter of credit or demand guarantee - ANZ in PDF format online at no cost:

Explore all the benefits of our editor today!

Fill out Application for standby letter of credit or demand guarantee - ANZ onlineWe've got more versions of the Application for standby letter of credit or demand guarantee - ANZ form. Select the right Application for standby letter of credit or demand guarantee - ANZ version from the list and start editing it straight away!

| Versions | Form popularity | Fillable & printable |

|---|---|---|

| 2019 | 4.8 Satisfied (175 Votes) | |

| 2011 | 4.5 Satisfied (26 Votes) |

We have answers to the most popular questions from our customers. If you can't find an answer to your question, please contact us.

What is the difference between a guarantee and a standby letter of credit?Legal Difference - There is a big legal difference between a bank guarantee and a Standby LC. A bank guarantee is an obligation subject to civil law whereas a standby LC is subject to banking protocols.

What is the difference between a letter of credit and a standby letter of credit?A Standby Letter of Credit is different from a Letter of Credit. An SBLC is paid when called on after conditions have not been fulfilled. However, a Letter of Credit is the guarantee of payment when certain specifications are met and documents received from the selling party.

What is standby letter of credit and how it works?A Standby Letter of Credit (SBLC / SLOC) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be made even if their client cannot fulfill the payment. It is a payment of last resort from the bank, and ideally, is never meant to be used.

What are 4 types of letter of credit?There are four types of Letters of Credit and they are given below. A revocable letter of credit. An irrevocable letter of credit. A standby letter of credit. Revolving letter of credit.

What is SBLC draft?A standby letter of credit (SBLC) refers to a legal instrument issued by a bank on behalf of its client, providing a guarantee of its commitment to pay the seller if its client (the buyer) defaults on the agreement.