Reviewing a potential tenant’s credit report is an important part of the tenant screening process.

Oftentimes, applicants have several large debt payments already (outside of their rent payment) and a history of late or delinquent payments on these debts. When that happens, it can significantly increase the chances of delinquent rent payments while they are renting from you.

Rental property applicants should have a credit score that meets or exceeds 600 and have no collections on their record. Verifying that each applicant’s credit history meets this minimum requirement helps increase the chance that the tenant will pay their rent on time each month.

With those main points in mind, I’ll cover everything you need to review an applicant’s credit history so you can find a tenant who is more likely to pay on time below.

The two biggest problems when dealing with tenants are rent collection and maintenance requests. During the tenant screening process, it is our goal as self-managing landlords to try and find the tenants that will make both of these problems as close to non-existent as possible.

One way to make the rent collection process easier is to verify a potential tenant’s credit score, current debts, and collection history.

By reviewing a tenant’s credit history, we can attempt to assess a tenant’s financial stability and ability to pay rent on time. If their credit score is higher (600 or above), this shows us that the tenant has a history of being responsible with their money. Most people with good credit scores try to protect their score at all costs, so we can be fairly confident that they won’t want to risk getting potential late rent payments or evictions on their record.

Of course, a tenant’s life situation can (and likely will) change over time, so verifying they have a good credit score at the time of move-in is not a foolproof way to ensure the rent payments will come on time. But it is one of the biggest areas we want to check to see if they have a history of managing their money well.

When reviewing applications for your rental property, you want to look at the credit history of all applicants over 18 years old. Each applicant should have a minimum credit score of 600 with no collections on their record (discussed below).

Since everyone in the household over 18 years old will be responsible for the rent, we want to ensure all of them have a history of good money management. The last thing we want is for only one tenant to have a good handle on the money management, then that tenant moves out and the tenant with a track record of poor money management is suddenly the only one responsible for paying the rent.

We currently have a tenant who consistently pays late/needs due date extensions because the previous property manager didn’t screen him when they screened his partner. At the time of move-in, the partner was responsible for the rent payment and she paid on time for the 5 years she lived there. Then one day, they broke up and she moved out. Now we get to deal with the tenant who did not get screened properly and does not like to pay rent on time because of every excuse in the book.

We chose to make the minimum credit score required to be 600 because it is considered a Fair credit score and our area average credit score is only 588 (which we found by Googling). Since the area average is so low, we wanted to be just above it so we were getting a little bit higher quality tenant without making the requirements too strict. If our area average had been 688, then we would have made our minimum requirement be 700.

Many people have made poor financial decisions in the past that can haunt them for years to come. We don’t want to hold all previous, bad financial decisions against the applicants, but we do need to be able to filter through some of them to find the tenants that can and will pay their rent on time.

(As a side note, so far, for every tenant that we’ve placed that had a 700 credit score or greater, I’ve never had to ask them where their rent payment is. They pay on time (and often early) to protect their 700 credit score.)

A collection on a tenant’s credit report means they chose not to pay a bill for over 30 days (often over 90 days) so the company had to sell the bill to a collection agency to try to collect that money. If we see someone has ever been in a situation where they decided not to pay a bill and the company had to resort to turning it to collections, then we know there is a higher risk that they will choose to not pay their rent and we might have to go through the eviction process one day as well.

RELATED How Much To Charge For Rent: Rent Pricing Guide For LandlordsThe only time we’ve ever made an exception on the collection requirement was when we had a Section 8 tenant with a full voucher that passed all of our minimum screening requirements besides the collection requirement. She had one small $69 collection on her record. When the amount is that small, it’s typically an error on the credit report.

When we asked her about it, she said it was a mistake and that she would get it taken care of right away. She paid the bill and got a letter from the collection agency saying it was paid, so we were able to move forward with her.

No, these requirements do not guarantee the applicants can pay on time every time, but it will increase the likelihood that they will be able to pay their rent on time since their credit history shows they’ve been responsible with their previous money.

Of course, you can’t control how tenants spend their money, but you can only allow tenants to rent from you that has the potential to have enough room in their budget to afford their rent payment and other financial obligations.

If the tenant’s underwater in debt and collections then you are already setting them up for failure because they will have a hard time affording rent and their daily life expenses.

Now that we know whose credit history we should review, let’s discuss what sections of their credit report we want to make sure we check.

The main areas we check when we decide whether they pass this minimum requirement or not are their credit score and their collection record. (We also look for any evictions on their record when evaluating their past rental history.)

However, if two applicants are close, then we will include frequent late payments, their debt-to-income ratio, and any foreclosures or bankruptcies on their record in the final decision if we uncover them.

The best way to review an applicant’s credit history is to order a credit report.

Our favorite tools to use are the free rental manager tools available on Apartments.com and Zillow.com. Both platforms have partnered up with a different credit bureau that provides a (free-to-the-landlord) background and credit report for any person who applies to your rental property listing.

When the tenant pays the application fee on Zillow or Apartments.com, they are actually paying for these two reports to be sent to you.

These reports have been a game-changer for us. In the past, we would speak briefly with the potential tenant asking basic questions about why they were moving before showing them the property. Then if they liked the place, we signed a lease with them. Yep, that was it.

You can guess how many problems we’ve run across over the years by “taking a tenant’s word”. It’s honestly sad because you want to believe everything you hear, but it’s as simple as the old adage goes, “Trust but verify.”

Honestly, we’ve only truly gotten 1 crazy person from that method who went months without paying rent, claimed there was mold throughout the building (no matter how many times we had it checked to ensure it wasn’t), and then finally disappeared on us without another word. It took months for the process to finally be resolved and a ton of lost money and damage to the property.

I’m guessing her credit history report would have shown she had a history of not paying her bills since she also left without paying her water or electric bill (they got shut off) and we could have avoided this whole mess.

Other than that one incident, the main problem we’ve come across by not screening properly is that several of the tenants struggled to pay their rent on time. If we had received a credit and background report on them, we probably would have been able to weed them out and saved ourselves hours chasing rent. You live and you learn!

Now, we make sure we have all potential tenants submit an application where we will be sent their background and credit reports. They can’t falsify these reports because they are sent directly from the credit bureaus.

If we see a credit score below 600 or any collections on their record, then they are automatically denied based on our minimum screening standards. Otherwise, they pass this minimum requirement and we check to see if they pass our other requirements.

RELATED How To Create A Rental Property Showing Packet (With Examples)Occasionally we have a scenario where the applicants either have no credit history (because they are either young or don’t use credit cards) or only one of the applicants pass the 600 credit score minimum with no collections. These situations can be a bit more tricky, but not a deal breaker.

Another way to get an applicant to pass our minimum credit requirement is to:

In Ohio, if we collect a security deposit that is a higher amount than the rent payment, we are legally required to pay the tenant 5% annual interest on the difference between the security deposit and the rent amount. Since we don’t want to mess with this, we never ask for a higher security deposit. (Your state might not have this requirement though, so a higher security deposit might be a great way to minimize risk.)

Instead, we require a co-signer if the applicant can’t pass the credit requirement on their own, but they still pass all of our other requirements. (If they don’t pass our other screening standards, then we just deny them and move on.)

A co-signer on a lease agreement is a person who is not living in the house, but is guaranteeing the rent will be paid by them if the tenant living in the house does not pay. First-time renters oftentimes need a co-signer because they typically don’t have rental history or credit history (since they are so young).

If you use Apartments.com or Zillow like we do to collect applications, then they have a feature where you can request a co-signer. The co-signer must also pass all of our minimum screening requirements otherwise the entire application will be denied.

As you are reviewing applicants’ credit history, be mindful of the Fair Housing Laws and the Fair Credit Reporting Act (FCRA).

We don’t want to discriminate based on race, religion, sex, color, national origin, familial status, or disability. Our only goal is to find the best applicant who will pay rent on time and take care of the property.

To comply with Fair Housing Laws, be sure to keep your screening standards as quantifiable as possible. Checking that the credit score is at least 600 and zero collections exist on their record is a quantifiable value that they either meet or they do not.

Then, if they do meet that minimum requirement, you can go one step further and compare their credit score to another applicant’s credit score when screening to choose the tenant with the better score because that is still a quantifiable number that has nothing to do with any of the discriminatory characteristics listed above.

For example, Applicant 1 has a 618 with no collections while Applicant 2 has a credit score of 721 with no collections. Depending on the other screening criteria, Applicant 2 might be the better tenant to choose because they have a longer history of managing their money and bill payments.

The better way to screen applications is on a first-come, first-served basis (if possible). Unless you hold an open house, you’re likely only getting in 1 application at a time. As each application comes in, review it right then and there.

If the application passes all of your minimum screening requirements, then you can schedule a showing with them and move forward with the lease signing process. And if they do not, then you reach out to let them and let them know what screening requirement they fell short on.

We’ve found that this helps us minimize problems because we are reviewing each application individually instead of comparing. They either pass the minimum requirements or they do not.

We also want to make sure we are in compliance with the Fair Credit Reporting Act (FCRA) and any other local laws regarding using credit reports to screen tenants.

Apartments.com and Zillow already get consent from the applicant for us when they submit an application, so we don’t have to worry about this. We also have a Release of Information form that we add to the end of our Showing Packets. After we show a home, we have the potential tenant sign this form and tear it from the packet so we also have a physical copy of their consent to review their background and credit report. (This extra step is not necessary, but we take it anyway just to add it to our records.)

On our listing and in our emails to potential applicants, we list our minimum screening standards so they know what to expect. And we send an Adverse Action Notice to every applicant that we deny explaining why they did not get the home (more on this below).

RELATED Top 21 Frequently Asked Questions By Tenants (And How To Answer Them!)Now that you’ve reviewed the applicant’s credit score and collection record (which probably took you all of 2 seconds), it’s time to decide if they meet this requirement or not.

If the credit score is less than 600 OR if there are any collections on their record, then the application fails (regardless of the other screening requirements) and a Tenant Application Decline/Adverse Action Notice Letter must be sent explaining what they failed on.

The only time we skip the credit score and collection requirement on an application is if we are filling a home with a Section 8 tenant. If they have a voucher that will cover their full rent price, then we pass them on this requirement because they aren’t responsible for any portion of the rent (all of the rent will come from Section 8).

But if they have a partial voucher, then we require that their credit score be 600 or higher with no collections on their record. This helps make the comparison fairer between Section 8 and non-Section 8 applicants because we only care about their credit score if we have to collect money from them. If we don’t (because Section 8 pays all of it), then this requirement is less important to us.

If the applicant’s credit score is greater than 600 and they have no collections on their record, then we check to see if they meet the other minimum screening requirements (income and employment history check, background check, rental history check). If they do, then we schedule a showing with them, otherwise, we send them an Adverse Action Notice Letter explaining what they failed on.

That’s it! By now, you have a great idea of how to review an applicant’s credit history for a rental property. Now, all that’s left to do is review their employment/income, background report, and rental history!

We’ve found that by verifying that an applicant’s credit score is at or above 600, they have no collections on their record, and they meet our other screening requirements, we get tenants that pay on time (and oftentimes in advance). This ultimately helps us run our rentals smoothly for only 5-10 hours a month.

I hope you find this article useful and that it helps you attract awesome tenants who would love to live in your rental home!

Catch you in my next post!

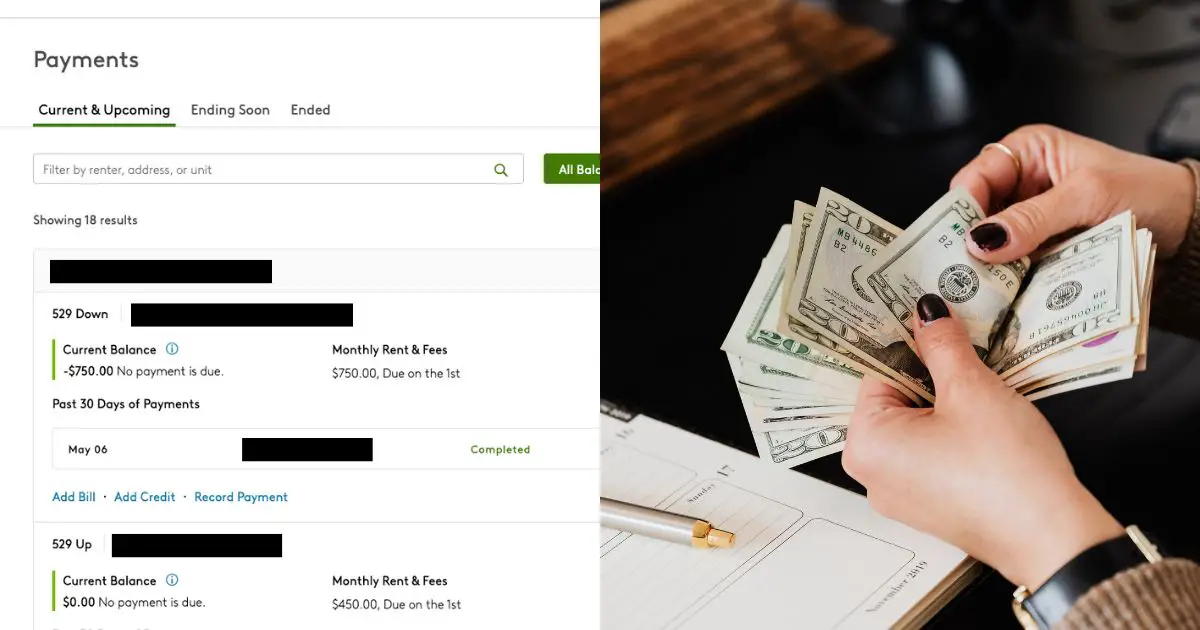

Check out my recommended tools, templates, and resources to free up your time from constantly working on and worrying about your rental properties. My husband and I use these tools to self-manage 18 rental units (and counting) for only 5-10 hours a month.

Keep in mind that most of these items are either free or reasonably priced for the amount of value that they provide. My goal on this page is to recommend tools, templates, and resources that we use daily and wish we had known about at the beginning of our landlord journey. Since implementing them, they’ve saved us countless hours and tons of headaches.

Finding good tenants for a rental property is arguably one of the most essential tasks that a self-managing landlord must accomplish. You’re searching for a high-quality tenant that will pay on time, take care of the property, and be easy to communicate with all while trying to get the most amount of rent and filling the vacant unit as quickly as possible.

Christine is a blogger and real estate investor/property manager who self-manages 18 rental units (and counting) alongside her husband, Adam. Although she successfully automates the management of her rentals and pockets the property management fee now, her path to success was not easy.

When you start to accept applications for your rental property, you’ll inevitably get some applications that do not meet your minimum screening standards (even if you list them in the listing, some people just don’t read or don’t care). When this happens, you’ll have to carefully review the application and send back a Tenant Application…

When we have found a new tenant that we are ready to sign a lease with, we want to start the new relationship off on the best terms possible. In order to do that, we need to ensure that they are familiar with the most important details of the lease. We do this by providing…

Collecting rent from tenants is one of the most time-consuming (and emotionally charged) parts of being a landlord. Not only will you get every excuse under the sun about why rent will be late this month (again), but you will also miss out on opportunities to collect extra income and increase rent over time if…

Hi there! My name is Christine! My posts are inspired by my and my husband, Adam's, everyday experiences self-managing our rental property portfolio.

From the newbie mistakes to avoid to the best way to automate the management of your properties and everything in between, I've got you covered!

My mission is to help others manage their rental properties better than the pros. Want to know more? Read my story, "From An Overwhelmed First-Time Landlord To A Pro Investor Self-Managing 18 Rentals On Less Than 10 Hours Per Month".

DIY Rental Manager is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com. DIY Rental Manager also participates in affiliate programs with ShareASale, CJ, Impact Radius, and other sites which means I may receive a small commission, at no cost to you, if you make a purchase through a link! Thank you for supporting my website!

Disclaimer: Please note that this is a personal blog where I share my personal experience, tips, and tricks about property management. All opinions are mine. You should not take anything from this blog as professional advice.