More Washingtonians are using commute alternatives. However, fewer employers are requesting the tax credit, and the credit likely has limited influence on the amount of financial incentives employers provide.

Estimated Biennial Beneficiary Savings

$4.1 Million (2021-23 biennium)

Tax Type

Employers may claim a tax credit against the business and occupation (B&O) tax or the public utility tax (PUT) for a portion of the financial incentives they provide their employees to use commute alternatives. Qualifying commute alternatives are:

Telework is not listed as a commute alternative for which employers may request Commute Trip Reduction (CTR) tax credits.

Employers can request a credit for up to 50% of the amount of financial incentives paid, subject to several limits. In any fiscal year, the amount of credit may not exceed: $60 per employee, $100,000 per employer, or $2.75 million statewide.

Employers must apply for the credit each year. If total credit applications exceed $2.75 million, the Department of Revenue (DOR) must reduce each application by an equal percentage to meet the cap.

The preference is scheduled to expire July 1, 2024.

When the Legislature extended the preference in 2015, it added a performance statement and mandated that JLARC review the CTR tax credit by the end of 2024. It also directed the Legislative Auditor to recommend continuing the preference if JLARC’s review finds an increase in the percentage of Washingtonians using commute alternatives.

The Legislature stated two public policy objectives for the credit and both have been met.

| Stated Objectives | Results |

|---|---|

| Increase percentage of Washingtonians using commute alternatives. | Met. The share of Washingtonians using commute alternatives increased from 27.5% to 29.2% between 2015 and 2019, and increased further during the pandemic. |

| Reduce traffic congestion, automobile-related air pollution, and energy use through employer-based commute trip reduction (CTR) programs. | Met. CTR survey data suggests improvements in congestion, pollution, and energy use. |

Although the policy objectives are met, the credit likely has limited influence on the incentives that employers provide to their employees and, by extension, on these objectives. JLARC staff found that fewer employers are currently requesting the credit compared to prior years, with the largest drop among smaller employers. Employers are paying more than the amount reimbursed through the credit and offer incentives for other reasons, such as local mandates, recruitment and retention, and voluntary sustainability efforts.

The Legislature should continue and modify the preference. Although more Washingtonians are using commute alternatives, the tax credit likely has limited influence on the amount of incentives that employers provide and on employee use of commute alternatives. Modifications to the credit might include:

Preliminary Report: Commute Trip Reduction

Employers This report collectively refers to credit users as "employers." Property managers may also claim the credit for financial incentives they provide to employees at worksites they manage. may claim a tax credit against their business and occupation (B&O) tax or public utility tax (PUT) liability for a portion of the financial incentives they provide their employees to use commute alternatives. Qualifying commute alternatives are:

Telework is not listed as a commute alternative for which employers may request Commute Trip Reduction (CTR) tax credits.

Employers can claim the credit as long as they offer financial incentives to their employees. These may include paying for all or a portion of the costs of public transportation, providing cash prizes, or offering additional paid leave. Employees who receive the incentives are not required to use commute alternatives.

To claim the credit, employers must submit an application to the Department of Revenue (DOR) in January following the year in which they provided the incentives. The credit is equal to 50% of the amount they paid in financial incentives, subject to several limits. In any fiscal year, the amount of credit may not exceed:

If total credit applications exceed $2.75 million, DOR must reduce each application by the same percentage so that the total credit awarded does not exceed the statewide cap (see section 2 for discussion of CTR tax credit usage).

The credit is not refundable, meaning it can only reduce taxes owed, but cannot result in a tax refund. If employers owe less in taxes than anticipated, they may not be able to claim the full amount of the credit they were allocated. The credit cannot be carried forward to future years.

Employers who claim the CTR tax credit are not required to submit an annual tax performance report.

The Legislature created a tax credit for commute trip reduction expenses in 1994 and has extended and amended it several times since. Changes include:

The Legislature added a tax preference performance statement in 2015 and directed JLARC to review the CTR tax credit by December 2024. The goals for the credit are to increase the percentage of Washingtonians using commute alternatives and to reduce:

The Legislature directed the Legislative Auditor to recommend continuing the preference if the review finds that there has been an increase in the percentage of Washingtonians using commute alternatives.

Washington's CTR program was enacted before the CTR tax credit. The CTR program is required of employers located within certain urban growth areas that meet specific criteria. Have 100 or more employees at a single worksite who begin their work day between 6-9 am. In contrast, employers who use the tax credit do so voluntarily. It is intended to encourage employers to provide financial incentives to their employees. Some employers participate in both programs, but employers are not required to have a CTR program in order to claim the tax credit.

Preliminary Report: Commute Trip Reduction

The number of employers applying for the credit declined between 2016 and 2020. A total of 669 employers applied for the credit in 2016. By 2020, this number dropped by 56% to 297.

During the COVID-19 pandemic, the number of employers requesting the CTR tax credit continued to fall. Because applications in one year reflect incentives paid in the previous year, the impacts of the pandemic are reflected in years 2021 and 2022, with a drop to 195 and 166 applications, respectively.

While the total number of applicants declined, the total number of employees covered in the applications was more stable. The decline in applications for the credit was concentrated among smaller employers. Between 2016 and 2020, the smaller employers had the largest percentage drop in applications:

During 2021 and 2022, the number of applicants fell for both large and small employers, likely due to the impact of the COVID-19 pandemic.

Between 2016 and 2020, the amount of credit requested exceeded the $2.75 million cap each year, and DOR was therefore required to prorate applications. During this time, employers reported paying between $24.7 million and $19.3 million per year in incentives to between 227,000 and 190,000 employees. Based on these incentive payments, employers:

As the number of applications declined during the pandemic, so did the amount by which DOR had to reduce credit awards.

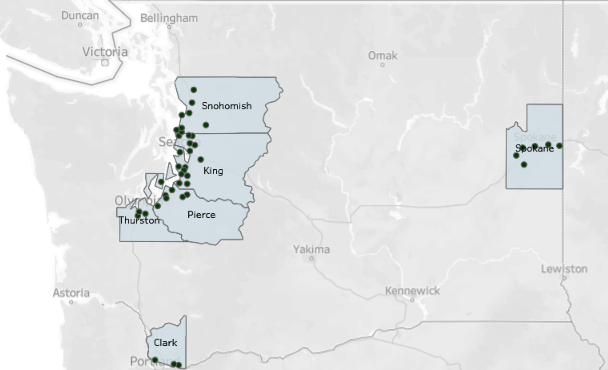

An analysis of employer records suggests that beneficiaries of the CTR tax credit are concentrated in King County. Between 2016 and 2020, an average of 410 employers claimed the CTR tax credit and 83% of them have King County addresses. The King County employers also claimed 83% of the credits and employed 86% of employees reported on credit applications.

Although DOR allocated $2.75 million in credit to applicants through 2021, not all of the applicants claimed their full credit allocation. Between 2017 and 2020, employers claimed an average $2.5 million of the $2.75 million allocated, or 91%. If employers owe less in taxes than the value of the credit they were awarded, they cannot claim the full amount they were allocated.

Exhibit 2.4 shows JLARC staff's estimate of beneficiary savings from the tax credit. Estimates for future years are based on the recent history of credit requests, including the following assumptions:

Preliminary Report: Commute Trip Reduction

When the Legislature extended the preference in 2015, it stated that the preference encourages employers to offer their employees financial incentives to use commute alternatives. JLARC staff identified several factors that suggest the tax credit has limited influence on the amount of incentives employers offer.

These limits have impacted large and small employers in different ways. The per-employer credit cap affects a small group of employers with more than 1,666 employees (see box). These large employers represent just 5% of the applicant pool, but 73% of the employees reported on CTR tax credit applications between 2016 and 2022.

From 2016-22, large employers were awarded an average of $900,000 in CTR tax credits per year, which reimbursed 6% of the $14.5 million in reported annual incentive payments.

Smaller employers Employers with fewer than 1,666 employees. are not affected by the per-employer cap. As a result, the credit reimburses a greater share of the incentives they report paying to employees. During the same period, they averaged $1.8 million in credits, reimbursing 30% of the average $5.9 million they paid in incentives.

As discussed in section 2, the number of credit applicants declined 56% from 2016 to 2020. Further, the decline is concentrated among smaller employers not subject to the per-employer cap. The number of employers with fewer than 250 employees declined by 62% between 2016-20, despite the relatively higher reimbursement rate when compared to large employers. These trends suggest the value of the credit may have limited influence on employer decisions about offering incentives.

Employers can report spending up to $120 per employee on the CTR tax credit applications. JLARC staff analysis found that employers provide financial incentives beyond what they report. This suggests that the actual reimbursement rate for large and small employers is less than 6% and 30%, respectively.

JLARC staff surveyed employers that applied for the credit in 2019. Respondents reported spending an average of $335 per employee on commute trip reduction incentives, with 85% of respondents spending more than $120 per employee. JLARC staff asked if the CTR tax credit increased the amount of financial incentives provided to employees:

JLARC's survey results are supported by data from King County's ORCA One Regional Card for All. Business Passport program (see box) which indicates that employers spent more than three times the amount for which they could request credit. In 2020, 455 employers with between 5-500 employees spent an average of $383 per employee on transit passes. This total includes 34 employers that requested the credit.

Employers with 500 or more employees with ORCA customized transportation pass programs also spend more on transit than can be reimbursed by the credit. In 2019, 58 such private employers, including 29 that requested the credit, spent $53 million on ORCA passports, nearly 20 times the statewide credit cap of $2.75 million.

The data above indicates that employers are spending more on incentives than can be reimbursed by the CTR tax credit. There are other reasons employers choose to offer incentives that are unrelated to the tax credit:

Preliminary Report: Commute Trip Reduction

The Legislature stated two main goals for the tax credit in its performance statement:

1. Increase the percentage of Washingtonians using commute alternatives.

2. Reduce traffic congestion, automobile-related air pollution, and energy use by changing the way employees commute to work.

Data from the U.S. Census and from the Washington Department of Transportation's CTR program indicate these policy objectives are being met. These data sources include both credit users and nonusers and identify trends in the use of commute alternatives and the impact of those trends on the environment.

Two related data sources show that Washingtonians are using commute alternatives more frequently than in the past.

Survey data shows Washington's use of commute alternatives, including telework Telework is considered a commute alternative in the survey data, but it is not a reimbursable expense for the tax credit. , is ahead of the national average. The percentage of Washingtonians commuting to work by a means other than driving alone increased by 1.7 percentage points between 2015 and 2019. During this same period, the measure for the country as a whole also improved, but by a relatively smaller margin (0.7 percentage points).

Because the COVID-19 pandemic complicated its survey methodology, the American Community Survey published experimental data for 2020 and cautioned against comparing to prior years. Due to this caution, 2020 data is not included in Exhibit 4.1, below. The experimental data does suggest the use of commute alternatives, including telework, increased sharply in 2020 – to 37.2% in Washington, and to 31% in the rest of the country.

The tax preference performance statement directs JLARC to use WSDOT's Commute Trip Reduction Program survey data to analyze whether more Washingtonians are using commute alternatives. Employees at CTR worksites are asked to complete surveys every two years about the way they travel to work.

The survey responses show an increase in the use of commute alternatives at CTR worksites and indicate employees at those sites use commute alternatives at a higher rate than the state average. The share of respondents using commute alternatives, including telework Telework is considered a commute alternative in the survey data, but it is not a reimbursable expense for the tax credit. , has increased over the past three survey cycles, with a steep increase at the onset of the COVID-19 pandemic. WSDOT reports that the increase in 2019/20 likely reflects the increasing number of employees who began teleworking.

JLARC staff further analyzed CTR employee survey data to identify:

Click the map image below to access an interactive dashboard that provides CTR-site detail by location.

In 2015-16 and 2017-18, more than 900 CTR worksites responded to the survey, reporting more than 560,000 employees. Fewer CTR work sites responded as the COVID-19 pandemic began. Data for the 2019-20 survey cycle reflects 800 CTR sites, and just over 500,000 employees.

JLARC staff compared the CTR sites to employers that claimed a CTR tax credit. Among 2017-18 respondents to the CTR employee survey, 30% were from worksites where the employers claimed the tax credit. These sites tended to be larger employers and represented 52% of all employees working at CTR sites.

| Claimed Tax Credit | Did Not Claim Credit | |

|---|---|---|

| CTR Sites | 277 (30%) | 660 (70%) |

| Employees | 313,398 (52%) | 284,388 (48%) |

Based on responses to the CTR survey, JLARC staff calculated statewide measures of annual vehicle-miles traveled, fuel consumed, and greenhouse gases emitted. Exhibit 4.6 shows these estimates and how commute alternatives have resulted in an overall reduction in each of these measures. The estimated decline in vehicle miles traveled equates to an annual reduction of 15 gallons of fuel consumed and 0.13 metric tons of greenhouse gases emitted per employee from 2015-16 to 2017-18.

The Legislature directed JLARC to use the CTR survey data to analyze whether the tax credit helped to reduce traffic congestion, air pollution, and energy use. While the survey results show reductions across these measures, it is difficult to know the extent to which the tax credit influenced those reductions. The CTR survey data is a sample of commuters who may or may not work for employers claiming the tax credit. They also may not be representative of the state as a whole. National research indicates that the influence of commuting behavior is most effectively measured on a local level. The effects of some commute reduction strategies may be heavily determined by whether:

For these reasons, it is unclear to what extent the CTR program and tax credit influenced the overall reduction in congestion, pollution, and energy use.

Preliminary Report: Commute Trip Reduction

The definitions in this section apply throughout this chapter and *RCW 70.94.996 unless the context clearly requires otherwise.

(1) "Applicant" means a person applying for a tax credit under this chapter.

(2) "Car sharing" means a membership program intended to offer an alternative to car ownership under which persons or entities that become members are permitted to use vehicles from a fleet on an hourly basis.

(3) "Nonmotorized commuting" means commuting to and from the workplace by an employee by walking or running or by riding a bicycle or other device not powered by a motor.

(4) "Public agency" means any county, city, or other local government agency or any state government agency, board, or commission.

(5) "Public transportation" means the same as "public transportation service" as defined in RCW 36.57A.010 and includes passenger services of the Washington state ferries.

(6) "Ride sharing" means the same as "ride sharing" as defined in RCW 46.74.010, including ride sharing on Washington state ferries.

(7) "Telework" means a program where work functions that are normally performed at a traditional workplace are instead performed by an employee at his or her home at least one day a week for the purpose of reducing the number of trips to the employee's workplace.

(1) Employers in this state who are taxable under chapter 82.04 or 82.16 RCW and provide financial incentives to their own or other employees for ride sharing, for using public transportation, for using car sharing, or for using nonmotorized commuting before January 1, 2024, are allowed a credit against taxes payable under chapters 82.04 and 82.16 RCW for amounts paid to or on behalf of employees for ride sharing in vehicles carrying two or more persons, for using public transportation, for using car sharing, or for using nonmotorized commuting, not to exceed sixty dollars per employee per fiscal year.

(2) Property managers who are taxable under chapter 82.04 or 82.16 RCW and provide financial incentives to persons employed at a worksite in this state managed by the property manager for ride sharing, for using public transportation, for using car sharing, or for using nonmotorized commuting before January 1, 2024, are allowed a credit against taxes payable under chapters 82.04 and 82.16 RCW for amounts paid to or on behalf of these persons for ride sharing in vehicles carrying two or more persons, for using public transportation, for using car sharing, or for using nonmotorized commuting, not to exceed sixty dollars per person per fiscal year.

(3) The credit under this section is equal to the amount paid to or on behalf of each employee multiplied by fifty percent, but may not exceed sixty dollars per employee per fiscal year. No refunds may be granted for credits under this section.

(4) A person may not receive credit under this section for amounts paid to or on behalf of the same employee under both chapters 82.04 and 82.16 RCW.

(5) A person may not take a credit under this section for amounts claimed for credit by other persons.

This section is the tax preference performance statement for the tax preference contained in RCW 82.70.020. This performance statement is only intended to be used for subsequent evaluation of the tax preference. It is not intended to create a private right of action by any party or be used to determine eligibility for preferential tax treatment.

(1) The legislature categorizes this tax preference as one intended to induce certain designated behavior by taxpayers as indicated in RCW 82.32.808(2)(a).

(2) It is the legislature's specific public policy objective to reduce traffic congestion, automobile-related air pollution and energy use through employer-based programs that encourage the use of alternatives to the single-occupant vehicle traveling during peak traffic periods for the commute trip. It is the legislature's intent to extend the commute trip reduction tax credit, which encourages employers to provide financial incentives to their employees for using ride sharing, public transportation, car sharing, or nonmotorized commuting. Pursuant to chapter 43.136 RCW, the joint legislative audit and review committee must review the commute trip reduction tax credit established under RCW 82.70.020 by December 1, 2024.

(3) If a review finds that the percentage of Washingtonians using commute alternatives is increasing, then the legislature intends for the legislative auditor to recommend extending the expiration date of the tax preferences.

(4) In order to obtain the data necessary to perform the review in subsection (3) of this section, the joint legislative audit and review committee should refer to the office of financial management's results Washington sustainable transportation performance metric or data used by the department of transportation's commute trip reduction program.

(1) Application for tax credits under this chapter must be received by the department between the first day of January and the 31st day of January, following the calendar year in which the applicant made payments to or on behalf of employees for ride sharing in vehicles carrying two or more persons, for using public transportation, for using car sharing, or for using nonmotorized commuting. The application must be made to the department in a form and manner prescribed by the department. The application must contain information regarding the number of employees for which incentives are paid during the calendar year, the amounts paid to or on behalf of employees for ride sharing in vehicles carrying two or more persons, for using public transportation, for using car sharing, or for using nonmotorized commuting, and other information required by the department.

(2) The department must rule on the application within sixty days of the deadline provided in subsection (1) of this section.

(3)(a) The department must disapprove any application not received by the deadline provided in subsection (1) of this section except that the department may accept applications received up to fifteen calendar days after the deadline if the application was not received by the deadline because of circumstances beyond the control of the taxpayer.

(b) In making a determination whether the failure of a taxpayer to file an application by the deadline was the result of circumstances beyond the control of the taxpayer, the department must be guided by rules adopted by the department for the waiver or cancellation of penalties when the underpayment or untimely payment of any tax was due to circumstances beyond the control of the taxpayer.

(4) After an application is approved and tax credit granted, no increase in the credit is allowed.

(5) To claim a credit under this chapter, a person must electronically file with the department all returns, forms, and other information the department requires in an electronic format as provided or approved by the department. Any return, form, or information required to be filed in an electronic format under this section is not filed until received by the department in an electronic format. As used in this subsection, "returns" has the same meaning as "return" in RCW 82.32.050.

Any person who knowingly makes a false statement of a material fact in the application required under RCW 82.70.025 for a credit under RCW 82.70.020 is guilty of a gross misdemeanor.

(1)(a) The department must keep a running total of all credits allowed under RCW 82.70.020 during each fiscal year. The department may not allow any credits that would cause the total amount allowed to exceed $2,750,000 in any fiscal year.

(b) If the total amount of credit applied for by all applicants in any year exceeds the limit in this subsection, the department must ratably reduce the amount of credit allowed for all applicants so that the limit in this subsection is not exceeded. If a credit is reduced under this subsection, the amount of the reduction may not be carried forward and claimed in subsequent fiscal years.

(2)(a) Tax credits under RCW 82.70.020 may not be claimed in excess of the amount of tax otherwise due under chapter 82.04 or 82.16 RCW.

(b) Through June 30, 2005, a person with taxes equal to or in excess of the credit under RCW 82.70.020, and therefore not subject to the limitation in (a) of this subsection, may elect to defer tax credits for a period of not more than three years after the year in which the credits accrue. For credits approved by the department through June 30, 2015, the approved credit may be carried forward and used for tax reporting periods through December 31, 2016. Credits approved after June 30, 2015, must be used for tax reporting periods within the calendar year for which they are approved by the department and may not be carried forward to subsequent tax reporting periods. Credits carried forward as authorized by this subsection are subject to the limitation in subsection (1)(a) of this section for the fiscal year for which the credits were originally approved.

(3) No person may be approved for tax credits under RCW 82.70.020 in excess of $100,000 in any fiscal year. This limitation does not apply to credits carried forward from prior years under subsection (2)(b) of this section.

(4) No person may claim tax credits after June 30, 2024.

The director must on the 25th of February, May, August, and November of each year advise the state treasurer of the amount of credit taken under RCW 82.70.020 during the preceding calendar quarter ending on the last day of December, March, June, and September, respectively.

The commute trip reduction board must determine the effectiveness of the tax credit under RCW 82.70.020 as part of its ongoing evaluation of the commute trip reduction law. The department must provide requested information to the commute trip reduction board for its assessment.

Chapter 82.32 RCW applies to the administration of this chapter.

Except for RCW 82.70.050, this chapter expires July 1, 2024.

Preliminary Report: Commute Trip Reduction